Figure AI values itself at $39 Billion

If you can't beat them, out fund them.

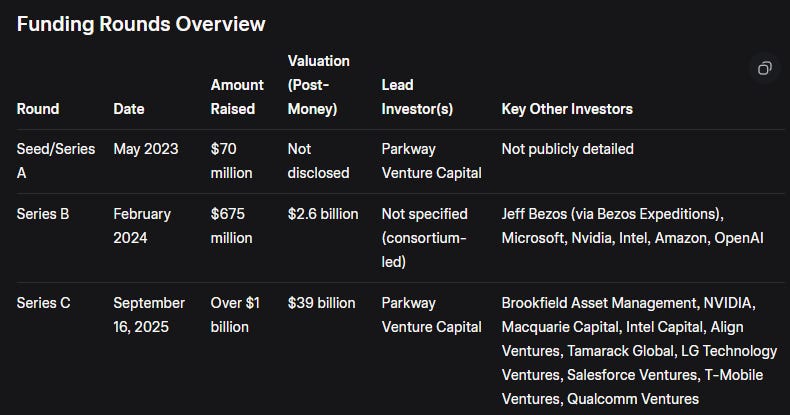

A week ago Figure AI got a huge Series C found but the valuation seemed well, a bit off.

Figure AI is one of dozens of humanoid robotics startups, that shows a lot of potential but are still in the early phases of the company. Real customers are few to non-existent.

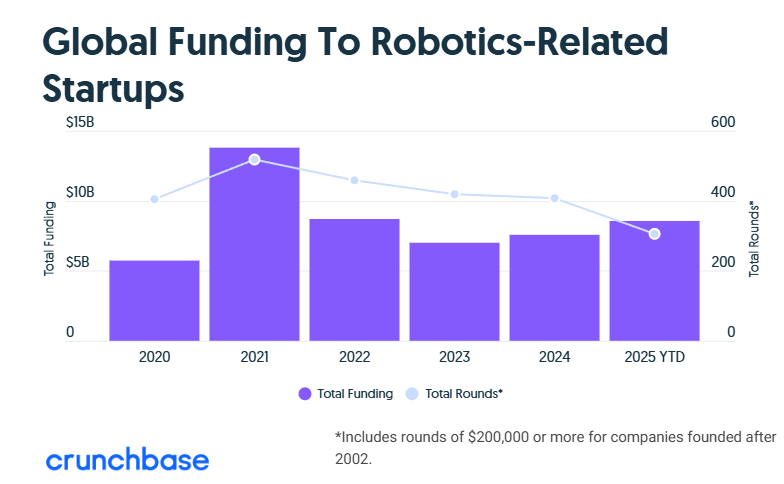

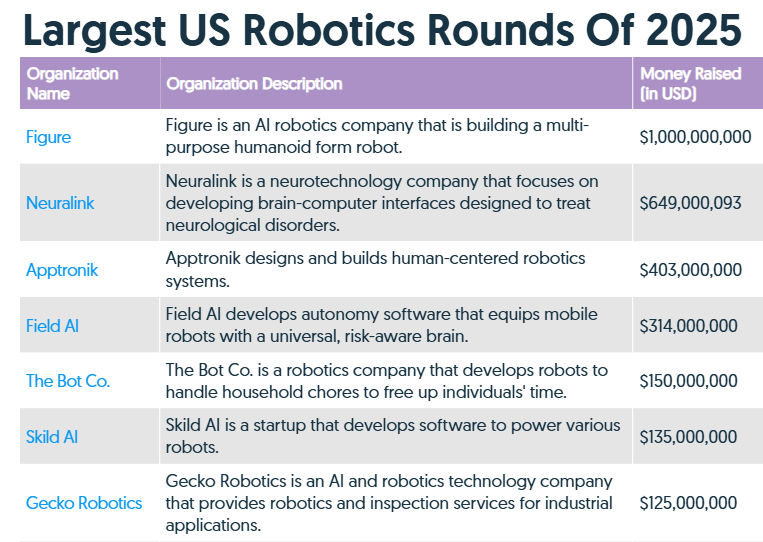

So far 2025 has been a great year for funding in Robotics. So is this the OpenAI of Robotics? The size of the private valuation looks very odd - in a world where suddenly Robotics startup funding has hit the highest point in years, boosted by another giant round for a developer of so-called “humanoids.”

Earlier this year, Figure CEO Brett Adcock claimed that Figure was the most “sought-after” stock on the private market. The former farm-boy is now an Emerging tech Founder of American clout.

Figure AI said it plans to build out its Helix embodied intelligence platform and the BotQ high-volume production environment unveiled in March. The company plans to ship 100,000 humanoids over the next four years.

The Series C round was led by Parkway Venture Capital, and also saw participation from industry majors such as Nvidia, Intel Capital, LG Technology Ventures, Salesforce, T-Mobile Ventures, and Qualcomm Ventures.

Nvidia

Intel

Salesforce

Qualcomm

This is noticeable semiconductor backing for the robotics hardware company.

The company tries to gain momentum by sharing viral videos of its robots folding laundry or emptying the dishwasher, even when it wasn’t supposed to be a consumer first humanoid. With China racing ahead, Figure and Tesla are making big promises.

The U.S. which is about a decade behind China in both automated manufacturing and energy systems, claims Figure, founded in 2022 by Archer founder Brett Adcock, plans to use the Series C money to scale its artificial intelligence platform and manufacturing capabilities.

Mission Statement for 2026 and Product

Scaling humanoid robots into homes and commercial operations. We are expanding production manufacturing at BotQ and real-world deployments, enabling robots to assist with household and commercial workforce tasks.

Building next-generation GPU infrastructure to accelerate training and simulation. This compute foundation will power Helix’s core models for perception, reasoning, and control.

Launching advanced data collection efforts. These include data collection of human video and multimodal sensory inputs, to improve how robots understand and operate in complex, dynamic settings. These real-world datasets are essential to scaling Helix’s capabilities.

To be clear, Figure AI has achieved commercial sales of its humanoid robots. But it’s small to non-existent thus far.

It’s not clear how would want to purchase them and for what.

In early 2025, Figure AI CEO Adcock boasted that a “fleet” of Figure’s humanoid robots were already performing “end-to-end operations” for BMW. But internet sleuth consensus is that this was fairly exaggerated.

While Figure AI and Tesla are worried about keeping up with Chinese humanoid robotics makers, they are hoping throwing more money at the problem can give them an edge.

There’s also a notable absence of critical takes on Figure AI’s business, innovation and pace relative to Chinese players in humanoid robotics online. That’s usually a flashing red warning sign.

“Figure brings together the dexterity of the human form and cutting edge AI to go beyond single-function robots, lending support at home and across manufacturing, logistics, warehousing, and retail.”

The marketing tries too hard, and the updates are vague and generic. It’s hard to know where Figure AI actually stands relative to Chinese players, although we do know that they will build robotics in a very costly manner.

Figure AI’s robots are expected to be most useful in warehouse and logistics environments yet the marketing appears to show their robots in home environments. Which is very confusing.

Still, few robotics startups have managed to raise nearly $2 Billion in three years. Some of Figure’s biggest investors include Jeff Bezos, Microsoft, Nvidia and OpenAI startup fund. It’s looking more like OpenAI will end up being a competitor and will be unable to acquire Figure.

Top Investors by Prominence and Involvement

Based on leadership roles, repeat investments, and scale of described commitments, the biggest investors are:

Parkway Venture Capital: Led all major rounds to date, making it the single largest backer by involvement.

NVIDIA: Participated in Series B and provided significant investment in Series C; a key strategic partner for AI hardware.

Intel Capital: Joined Series B and contributed significantly to Series C.

Align Ventures: Involved in Series B and Series C.

Jeff Bezos (via Bezos Expeditions): Made a major personal investment in Series B.

Microsoft: Key Series B investor, providing strategic AI and cloud support.

Brookfield Asset Management: Significant new commitment in Series C, focused on scaling manufacturing.

OpenAI Startup Fund: Major Series B backer, though the partnership ended in early 2025 in favor of Figure's in-house AI development.

Macquarie Capital: Significant Series C investor.

Brookfield is a major partner as well. Total funding to date exceeds $1.75 billion, though some sources estimate closer to $2.34 billion when accounting for the full Series C commitments. Neither is Figure AI very transparent. At one point it looked like their main competitor would be Tesla, but other robotics startups have surged ahead.

Figure AI has attracted over 90 investors in total, including speculative emerging tech investors like Cathie Wood’s ARK Invest, not usually a good sign. Peter Diamandis is a notable investor in Figure AI, with several “Moonshot” Podcasts with the founder. What’s clear is humanoid robotics will be a ruthlessly competitive market race where China might have the upper hand given lower costs of manufacturing.

Adcock, who previously launched Vettery and Archer Aviation, began by hiring top robotics experts and raising $70 million in venture capital back in 2022. The AI bull market is lacing robotics startups with cash, with many fascinating newcomers. Many of which I’m watching closely and will cover in due course.

This new funding will support Figure's momentum across three core areas:

→ Scaling humanoid robots into homes & commercial operations

→ Building next-generation GPU infrastructure to accelerate training & simulation

→ Launching advanced data collection efforts for Helix

I can’t help but notice how hard robotics training and hardware is especially with the form factor of humanoid robots. These are hard engineering problems, even with the boost from Generative AI in certain ways (“world models” with better real world simulations come to mind).

Robotics startups really get going more in the 2027 to 2032 period imho. These are still very early days. China is more prepared to compete in robotics as compared to how quickly Generative AI commercialized itself. We know that Unitree Robotics is preparing to go public and has begun the IPO process, with applications expected to be filed between October and December 2025.

Elon Musk has made enormous claims about Tesla’s robotics potential, yet most of his time since leaving DOGE has been with xAI, not Tesla which is telling. Most coverage of robotics funding also only takes Western companies into account:

It’s difficult to say how competitive Figure AI is going to be, given how crowded the humanoid robotics market is going to get and companies like Apple, Amazon and Google may take bigger swings in the near future as well as Chinese Tech giants.

Figure AI Rundown:

So in a nutshell you are basically caught up on Figure AI:

Outside of their lingo of BotQ, Helix and so forth:

Company Overview: Figure AI is an AI robotics company founded in 2022, focused on developing the world's first commercially viable autonomous humanoid robots to address labor shortages in manufacturing, logistics, warehousing, retail, and households.

Mission: The company's goal is to create general-purpose humanoid robots with human-level intelligence that can perform a wide range of tasks autonomously, starting from commercial operations and expanding to homes.

Leadership: Founded and led by CEO Brett Adcock, who previously founded Archer Aviation and Vettery; the team includes experts with over 100 years of combined AI and humanoid robotics experience.

Headquarters: Based in San Jose, California, with facilities for testing and manufacturing.

Products - Figure 01: Early prototype humanoid robot demonstrated in pilots, such as a two-week test with BMW in 2024 for automotive manufacturing tasks.

Products - Figure 02: Current flagship model, a 5'6" tall, 70kg electric humanoid with 20kg payload capacity, 5-hour runtime, and 1.2 m/s speed; capable of end-to-end operations like folding laundry, sorting packages, and loading dishwashers.

Technology - AI-First Approach: Combines human-like dexterity with advanced AI to enable robots to interact with human-built environments, including opening doors, using tools, climbing stairs, and lifting boxes.

Technology - Helix Model: Proprietary vision-language-action (VLA) neural network that processes language and pixel inputs to output manipulation and navigation actions end-to-end; trained on real-world data for tasks like autonomous dishwasher loading without custom engineering.

Technology - Learning from Video: Helix now learns navigation directly from human video data, marking the first instance of a humanoid robot achieving end-to-end navigation using only such inputs.

Funding History: Raised $675 million in Series B in 2024 at a $2.6 billion valuation, backed by investors including Microsoft, Amazon's Jeff Bezos, NVIDIA, and Intel Capital.

Recent Funding - Series C: Exceeded $1 billion in committed capital announced on September 16, 2025, at a $39 billion post-money valuation, led by Parkway Venture Capital.

Series C Investors: Includes Brookfield Asset Management, NVIDIA, Macquarie Capital, Intel Capital, Align Ventures, Tamarack Global, LG Technology Ventures, Salesforce Ventures, T-Mobile Ventures, and Qualcomm Ventures.

Use of Series C Funds: Accelerate scaling of humanoid robots into homes and commercial settings, build next-generation GPU infrastructure for training and simulation, and launch advanced data collection for Helix.

Partnerships - BMW: Collaborated since January 2024 on pilots for industrial applications in automotive manufacturing.

Partnerships - Brookfield: Announced September 17, 2025; leverages Brookfield's $1 trillion+ assets, including 100,000 residential units, 500 million sq ft offices, and 160 million sq ft logistics spaces for data collection and deployments.

Brookfield Collaboration Details: Focuses on building the world's largest humanoid pretraining dataset via human video capture in diverse environments to train Helix on movement, perception, and actions.

Commercial Deployments: Began shipping Figure 02 robots to first unnamed paying customer in December 2024; robots actively performing tasks.

Additional Sales: Signed second major U.S. company customer in January 2025, with potential for up to 100,000 robots over four years to support production scaling and AI data.

Current Operations: As of September 2025, Figure 02 robots are operational for multiple early commercial customers, including expansions via Brookfield in logistics, warehousing, and residential sectors.

Manufacturing - BotQ: In-house production facility expanding to enable high-volume manufacturing of humanoid robots.

Data Initiatives - Project Go-Big: Launched September 18, 2025; aims to create an internet-scale pretraining dataset for robotics, starting with Brookfield residential units; single Helix network now handles both manipulation and navigation.

Hiring Efforts: Actively recruiting across AI (Helix), manufacturing (BotQ), mechanical engineering, embedded systems, design/HMI, platform software, and systems integration to support scaling.

Future Plans: Deploy robots in new commercial sectors via Brookfield; scale AI infrastructure with GPU data centers; achieve human-level intelligence for household tasks like dishes, laundry, and grocery unpacking by 2026+.

Market Impact: Positioned as a leader in the humanoid robotics race amid a 75.6% surge in U.S. startup funding for AI in H1 2025; aims to unlock $50+ trillion in global labor savings.

The humanoid robotics market will be so distributed and have so many players and competitors it will be difficult for any single company to have much marketshare. Performance not hype will be paramount. The interesting thing about this race is Europe is also better positioned to actually participate.

Figure AI is still at the end of the day a very serious pure-play robotics company. Although they don’t seem to commit to being either B2B or B2C and that’s a worrying sign.

Unfortunately hype and funding only takes you so far. If the U.S. has the inside track in Generative AI products, you have to imagine China has the inside track on robotics and their more utilitarian capabilities of doing stuff in the real world. Like with EV makers, China just has so many more robotics startups than the U.S. could ever hope to have. This increase their chances of creating novel form-factors and odd robots we didn’t even think we needed. Penetration of robotics in manufacturing has historically been so much higher in Asia than in the United States, and there are cost efficiency reasons for this.